Before enrollment

How much does insurance cost?

Part of selecting a plan includes estimating how much it will cost and how it fits into your budget. Where to start? Here are some things to consider. There’s no easy answer! There are many things that go into counting up the cost of health insurance.

The answers to these questions may help you pick the best plan for you:

- How large is my family?

- Where do I live?

- What medications will we need and how often do we take them?

- How often do we seek medical care?

- Do I have any surgeries or procedures that are coming up?

- Does my family have any major healthcare concerns?

Costs can vary on all these things, but pre-existing conditions not affect the cost of your premium.

Let’s start with some definitions:

- Premium – this is the amount you pay every month to have your healthcare plan, in the same way you might pay monthly for your car insurance. If you get your insurance through your job, your employer may pay part of your monthly premium.

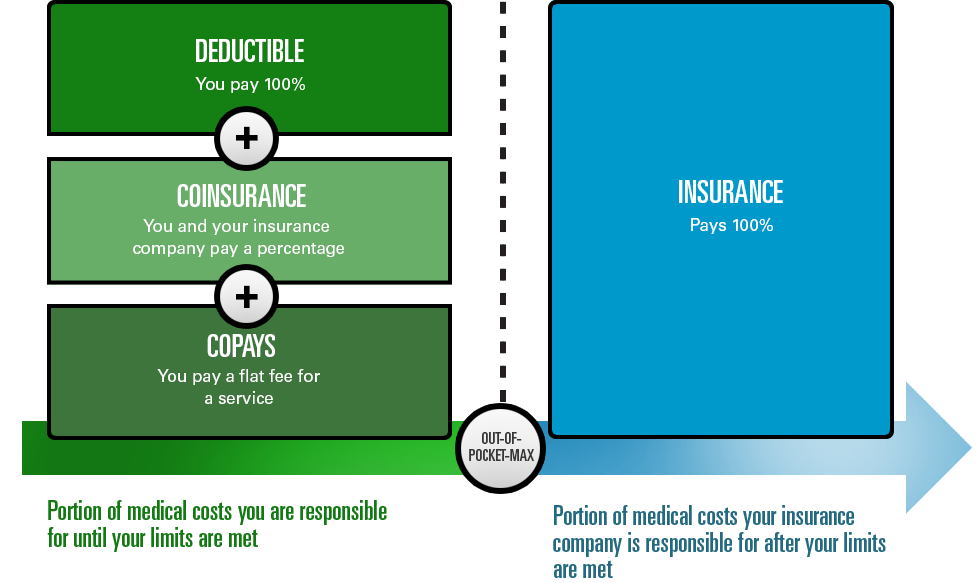

- Deductible – this is how much you will spend before your healthcare insurance begins to pay for covered services.

- Copay and coinsurance – these are payments you make each time you get a medical service before or after your deductible. Some plans or services don’t have a copay.

- Out-of-pocket maximum – the most you’ll spend for covered services in a year. After you reach this amount, your insurance company pays 100 percent for covered services.

How your medical expenses get paid

You and your insurance company share the cost of your care until you meet your out-of-pocket maximum for the year. Your deductible, coinsurance and copays add up to the out-of-pocket maximum. Regardless of the amount of care you receive, your monthly premium will need to be paid.

If you get your own insurance, there are several categories you can choose from in the Marketplace, often called the “metal” categories: Bronze, Silver and Gold.

Gold will pay more of your total costs of healthcare, but you’ll usually pay a higher monthly premium. Bronze and Silver usually pay less of your total costs, but you’ll usually have a lower monthly premium.

When looking at the plans, consider these three things:

- How often you get regular medical services (Not often? You may want a Bronze plan with a lower monthly premium, but remember it may have a high deductible and pay less of your costs).

- How many prescription medications you take (A lot? You might want a Gold plan, which has a higher monthly premium but pays more costs).

- If you qualify for a premium tax credit or extra savings (“cost-sharing reduction”), you’ll choose the Silver category or you may find out you’re eligible for Medicaid. The federal government’s healthcare website has a great calculator to help you decide if this is for you.

If you can estimate your yearly total healthcare costs that can also help you select a plan.

We’d like to join you on your journey to getting covered. Call or visit us. Ask questions. Choose your plan. We make it simple!

Call 800-392-2583 or make an appointment at one of our ArkansasBlue welcome centers.